Common questions associated with the JobKeeper Scheme

Since the release of the Government’s JobKeeper Scheme, the NTAA has fielded a number of queries from our tax agent members, looking to make an application for a JobKeeper Payment on behalf of their clients and, where applicable, their own practices. A number of these commonly asked questions are addressed below.

Question 1: Do businesses have to meet the decline in turnover test on an ongoing basis?

The answer is No. Whilst a business must satisfy the decline in turnover test in order to be entitled to a JobKeeper Payment, once it is satisfied, there is no requirement to retest in later JobKeeper Payment fortnights.

That is, the decline in turnover test only needs to be satisfied once. As a result, if a business can demonstrate that its turnover has been adversely impacted by at least 30% (or 50%, as the case may be), then it will continue to meet this requirement even if its turnover subsequently recovers in later JobKeeper fortnights.

Question 2: What if a business’s turnover has not decreased (e.g., by 30%) but it is predicted to do so in the coming month?

An employer can apply for the JobKeeper Scheme where it is reasonably expected that its GST turnover will fall by 30% or more (or 50% where applicable) relative to its GST turnover in a corresponding period a year earlier. Treasury has advised that the ATO will provide guidance about self-assessment of actual and anticipated falls in turnover.

Additionally, if a business does not meet the decline in turnover test as at 30 March 2020, the business can start receiving the JobKeeper Payment at a later time, once the decline in turnover test has been met. However, in this case, the JobKeeper Payment will not be backdated to the commencement of the scheme, although businesses can receive JobKeeper Payments up to 27 September 2020.

Question 3: Are employers required to continue to pay employees to qualify for the JobKeeper Payment?

The answer is Yes. Employers are required to satisfy the ‘wage condition’ in respect of an employee for the relevant JobKeeper fortnight in order to qualify for the JobKeeper Payment for that employee. As a reminder, the first JobKeeper fortnight commenced on Monday 30 March 2020 and ended on Sunday 12 April 2020 (i.e., the first JobKeeper fortnight has already ended).

Broadly speaking, a payment under the scheme is meant to be a reimbursement to the employer of an amount already paid to an eligible employee (who is participating in the JobKeeper Scheme). Specifically, the ‘wage condition’ requires the employer to pay each eligible participating employee at least $1,500 for each JobKeeper fortnight, which can be represented by salary, wages, PAYG withholding, salary-sacrificed superannuation contributions and other amounts applied or dealt with on behalf of the employee (i.e., an add-back of any salary sacrificed in return for fringe benefits).

If employers have insufficient cashflow to make such payments, Treasury has encouraged such businesses to speak to their banks about using the upcoming JobKeeper Payment as ‘collateral’ to seek short-term finance to pay their employees.

TIP – ATO concession for the first two JobKeeper fortnights

In the event that an employer does not meet the ‘wage condition’ (i.e., they have not paid an eligible employee a minimum amount of $1,500 in the fortnight), then they have not met all the requirements to be entitled to the JobKeeper Payment.

However, the Commissioner does have the power to treat a particular event (e.g., a payment) that happened in a fortnight as having happened in a different fortnight if the Commissioner believes that it is reasonable to do so. In this regard, the ATO has advised that for the first two fortnights (i.e., the fortnights ending 12 April 2020 and 26 April 2020), it will accept the minimum $1,500 as being paid in each fortnight, even if it has been paid late, provided it is paid by the end of April. As such, the ATO has effectively granted businesses an extension of time to pay the required $1,500 per fortnight to their eligible employees for the purposes of meeting the JobKeeper Payment requirements.

Question 4: If employees have been stood down after 1 March 2020 does an employer need to pay them?

The answer is Yes. As discussed above, employers will need to make payments to eligible employees, including employees who have been stood down. This means the employer must pay the stood down employee a minimum of $1,500 per fortnight (before tax) in the relevant fortnight (subject to the concession in the TIP above).

Where an employer pays their staff monthly, the monthly payment must be equivalent to the required fortnightly payments. For subsequent payment periods, an employer will need to continue to pay these employees who have been stood down a minimum of $1,500 (before tax) before the end of each relevant JobKeeper fortnight.

Question 5: Can employers select which of their eligible employees are covered by the JobKeeper Scheme?

The answer is No. Once an employer decides to participate in the JobKeeper Scheme, they must ensure that all of their eligible employees (who have agreed to be nominated for the scheme) participate in the scheme. This applies to all eligible employees (i.e., irrespective of whether they are still working for the employer or they have been stood down).

As the scheme is operated on an ‘one in, all in’ basis, employers cannot ‘pick and choose’ which eligible employees will be able to participate in the scheme.

Question 6: Are the JobKeeper Payments from the ATO assessable income to the business?

The answer is Yes. In the absence of any specific exemptions, the JobKeeper Payments received from the ATO by the business would be assessable income under either S.6-5 of the ITAA 1997 (as ordinary income) or S.15-10 of the ITAA 1997 (as a subsidy received by a business). However, salary or wage payments made by the business to their employees are allowable deductions.

Inevitably, a timing mismatch may arise in relation to the income year in which the assessable income is included and the income year in which the allowable deductions are claimed. This is because the salary and wages are required to be paid before a JobKeeper Payment is received from the ATO, however, this would generally work to the employer’s advantage. Specifically, there would be a timing mismatch in deductions claimed for salary and wages paid in June 2020 (deductible in the 2020 income year), whilst the JobKeeper Payment would not be received until, and hence assessable to the business in, July 2020 (i.e., the 2021 income year).

Question 7: Are employers required to deduct PAYG withholding from the amounts paid to employees?

The answer is Yes. Broadly speaking, employers are required to make payments of at least

$1,500 to each eligible employee every JobKeeper fortnight.

To the extent that these payments take the form of salary or wages, they would constitute assessable income to the employees, which means that employers would be required to deduct the appropriate amount of PAYG withholding. Therefore, on the basis that each eligible employee will receive at least $1,500 per fortnight, then at least $192 of PAYG withholding will need to be deducted (based on a fortnightly payment cycle) where the employee is claiming the tax-free threshold (assuming no salary packaging arrangement is in place).

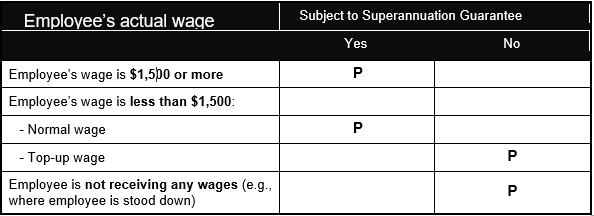

Question 8: Are employers subject to Superannuation Guarantee (‘SG’) in relation to any extra JobKeeper Payments?

The answer is No. The Government’s intention is that employers will only be required to make SG contributions for amounts payable to an employee in respect of their actual employment, which would not include any extra payments made by the employer to satisfy the $1,500 JobKeeper Payment ‘wage condition’. At the time of writing, the law is yet to be amended to reflect this.

For example, if an employee ordinarily earns $1,000 a fortnight and is ‘topped-up’ by $500 to $1,500 a fortnight, the employer will be required to pay SG in relation to the ‘usual’ $1,000 but may lawfully decide not to pay SG on the additional $500 payment, which is solely attributable to the JobKeeper Payment. In other words, in relation to the extra top-up amounts paid to the employee, it is up to the employer if they want to pay superannuation on these additional wages paid by the JobKeeper Payment.

An employer’s superannuation obligations are broadly summarised in the following table.

Question 9: Can businesses get the JobKeeper Payment in respect of workers who are engaged through a labour hire firm?

The answer is, unfortunately, No. Businesses will not qualify for a JobKeeper Payment in respect of workers engaged through a labour hire firm.

In order to qualify for the JobKeeper Payments, the individual must either be an eligible employee or an eligible business participant. In the case of workers who are engaged by the business through a labour hire firm, they do not generally have an employment relationship with the business, rather, the contractual relationship is between the business and the labour hire firm. As such, these workers are not employees of the business, which means the business will not qualify for JobKeeper Payments in respect of these workers.

TIP – Labour hire firms may qualify for JobKeeper Payments directly

Whilst these workers do not have an employment relationship with the business that they perform their services for, they may have an employment relationship with the labour hire firm that they are engaged through.

To the extent that these workers are ‘employees’ of the labour hire firm, then where the labour hire firm meets the relevant qualifying requirements, it may qualify for the JobKeeper Payment.

Question 10: Can a sole trader who has employees also qualify for the JobKeeper Payment?

The answer is Yes. On the basis that the sole trader’s business has satisfied all the other requirements to qualify for the JobKeeper Payment, a sole trader can qualify for the JobKeeper Payment in relation to their eligible employees and also qualify for the JobKeeper Payment themselves (i.e., in their own capacity) as an eligible business participant.

In order words, a sole trader’s entitlement to the JobKeeper Payment as an eligible business participant arises independently of their entitlement to the JobKeeper Payment in respect of their employees. Therefore, whether a sole trader has any employees or not will not impact on their ability to personally qualify for the JobKeeper Payment.

Make sure to connect with us on social media.